Asset managers face mounting pressure on their platform relationships as distribution costs continue to rise. With financial advisors increasingly focused on holistic planning and outsourcing investment decisions through model portfolios, platforms are demanding more support services, greater access to investment personnel, and higher revenue sharing. These challenges are particularly acute for boutique managers who must compete with larger firms while operating with limited resources.

Asset managers face mounting pressure on their platform relationships as distribution costs continue to rise. With financial advisors increasingly focused on holistic planning and outsourcing investment decisions through model portfolios, platforms are demanding more support services, greater access to investment personnel, and higher revenue sharing. These challenges are particularly acute for boutique managers who must compete with larger firms while operating with limited resources.

I spoke with Loren Fox, Director of Research at FUSE Research Network, about the strategic decisions asset managers face today and how firms of different sizes can maintain profitable relationships in this evolving landscape.

Q: Why should profitability be the key focus for asset managers in their platform relationships?

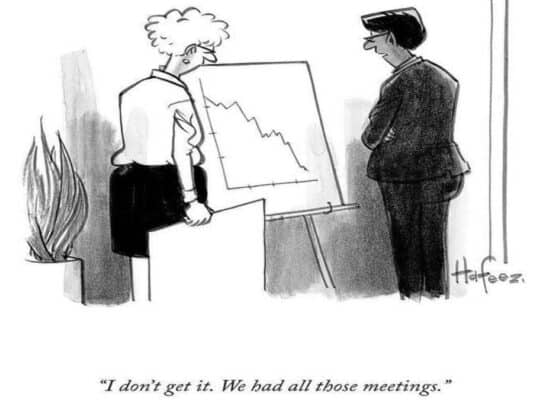

A: What’s interesting is that when we survey heads of national accounts, they typically rank things like model portfolio inclusion and platform placement at the top of their priority list. Platform profitability often ranks sixth or lower in importance. That’s a real problem because at the end of the day, profitability determines whether these relationships are sustainable.

The compensation structure for salespeople is still heavily based on gross sales, but most firms still make the bulk of their money from legacy assets rather than new sales. It’s becoming critical for asset managers to evaluate which strategic partners are truly strategic from a profitability perspective. The platform with the most advisors isn’t necessarily your best partner.

Q: What’s driving the cost pressure from platforms?

A: There are several fundamental changes happening in our industry. For a long time, platforms have looked at the higher operating margins at asset managers and thought, “We need to ask more of our partners because our margins should be closer to theirs.”

But there’s also a significant evolution happening in the role of financial advisors. We’re seeing less emphasis on investment management and more focus on holistic services like financial planning and estate planning. This shift has led to greater willingness to outsource investment management through model portfolios, which are growing rapidly. That creates new challenges for asset managers because it becomes harder to differentiate when you’re just offering a sleeve within a larger model portfolio. Standing out often requires asset managers to provide more support.

The RIA channel is particularly interesting here. With the growth of RIA aggregators, these larger entities are starting to look more and more like traditional broker-dealers regarding their demands for support, data access, and even revenue sharing. That’s creating additional cost pressures in what was traditionally a more straightforward channel.

Q: What major costs are firms managing, and how are they adapting?

A: Personnel costs continue to be the biggest expense. Platforms now typically want multiple layers of coverage. They want boots on the ground to help support their advisors in the field, but also dedicated people calling on the home office who can handle all the business and operational issues. They want separate contacts for their due diligence analysts. And increasingly, they expect different specialists to accompany the wholesalers – people who really know the products inside and out, particularly for complex offerings like alternatives.

They also want client portfolio managers who can speak on behalf of the investment team when the actual portfolio manager isn’t available, and portfolio construction specialists who can help advisors optimize product implementation.

One interesting trend is the growing use of junior national accounts people. While they may not come with existing relationships like senior managers, if they’re mentored correctly, they can be very cost-effective in handling many of the basics.

Beyond personnel, data costs keep growing. Platforms are selling advisor data packages that many asset managers feel they need to buy. Conference spending is another area where firms draw clear lines – continuing support for top-tier strategic partners while cutting back on second-tier relationships where they don’t see sufficient return.

Q: How can firms make their relationships more effective through meetings and ongoing engagement?

A: Success starts before you even get to the meeting. Firms need to be sophisticated in identifying and qualifying prospects by combining multiple data sources and tracking engagement with their content and marketing efforts.

An advisor who’s been regularly tuning into your portfolio manager’s market updates and downloading your white papers will be a much warmer prospect than someone who looks good on paper but has never engaged with your firm. The same principle applies at the platform level – if you can get your story across and they find it compelling, they often want to stay in touch for future opportunities.

This ongoing engagement is critical. Content marketing is like fishing – you need to keep casting your line regularly to get nibbles. Due diligence analysts at major distributors tell us that even if they don’t have a place for your product right now, they want you to stay in touch if your story is compelling. Things change – they might drop an underperforming manager or shift their model portfolios.

The most successful firms take what I’d call a “drip approach,” maintaining consistent, meaningful communication that keeps them on people’s radar. When an advisor engages with your content, that becomes invaluable data for identifying your warmest prospects.

Q: What do these trends mean for boutique asset managers?

A: Being nimble can be an advantage for boutiques. They can often make decisions more quickly – there’s not a big committee that everything needs to go through. But they need to be almost merciless in their prioritization. You simply can’t provide white glove service to 30 firms if you’re a boutique manager.

This is where content and digital engagement become powerful tools for boutiques. While they might not have the personnel to maintain constant in-person coverage, they can leverage thought leadership and digital marketing to maintain a steady presence with their target platforms. That “drip approach” we talked about – consistently sharing insights and expertise – can help level the playing field. When a boutique’s portfolio manager shares unique perspectives or market insights, that content can reach just as many eyes as content from larger firms.

I think the future might look a bit like what some people do with streaming services – they never have more than four at a time, but they keep shifting them around based on what’s available. Boutiques might need to take a similar approach with their strategic partners. Try one distributor for a while, see how it goes, and be patient, but also be ready to pivot to better opportunities where you can make better use of limited resources.

Q: What’s your outlook for platform relationships going forward?

A: The old model of maintaining dozens of strategic partnerships and hoping for the best isn’t sustainable. The most successful firms are taking a focused approach, being selective about their partnerships and using data effectively to target the right opportunities.

The costs aren’t going down anytime soon. If anything, platforms are going to keep asking for more. The key to sustainability is getting better at identifying which relationships can generate profitable growth over time. It’s about being on the right platforms, with the right level of support, and making sure each relationship contributes positively to the bottom line. Don’t be afraid to make changes if a platform requires too much client service, or if your message isn’t getting amplified or if there’s more asset churn than you’d expected. In today’s environment, profitability has to drive these decisions – it’s not just about getting more assets anymore.

Want to discuss how these trends affect your distribution strategy? Learn how to develop targeted distribution strategies, optimize your platform coverage model, and leverage thought leadership to maintain presence cost-effectively. To schedule a strategy session, visit our scheduling link.

Dan Sondhelm is the CEO of Sondhelm Partners, a firm that helps boutique asset managers struggling to grow their AUM, feel overlooked in a crowded market, and wants to spark more meaningful conversations with prospects.

Connect