Are you considering a commitment of resources to growing one of your mutual funds? Are you thinking about adding a fund to your lineup? One question you might not have considered: Is your timing right? The decision to commit to launching or growing a fund isn’t just about getting it into the market or trying Read more »

Are you considering a commitment of resources to growing one of your mutual funds? Are you thinking about adding a fund to your lineup? One question you might not have considered: Is your timing right? The decision to commit to launching or growing a fund isn’t just about getting it into the market or trying Read more »

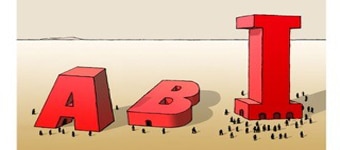

Do asset managers—big, boutique and growing—need yet another new share class? The answer is yes if you want to be fiduciary-friendly. The long-delayed implementation of some of the DOL’s new fiduciary rules finally went into effect on June 9. While there is a possibility that some of the provisions will be modified in the coming

Do asset managers—big, boutique and growing—need yet another new share class? The answer is yes if you want to be fiduciary-friendly. The long-delayed implementation of some of the DOL’s new fiduciary rules finally went into effect on June 9. While there is a possibility that some of the provisions will be modified in the coming  A growing number of fund companies realize that Registered Investment Adviser (RIA) firms are the future of the intermediary business. This is a challenge for fund distribution teams, since traditional product-focused email marketing campaigns and wholesaler “greet, meet and eat” strategies that work in broker/dealers don’t align with a business model where fiduciary responsibilities, rather

A growing number of fund companies realize that Registered Investment Adviser (RIA) firms are the future of the intermediary business. This is a challenge for fund distribution teams, since traditional product-focused email marketing campaigns and wholesaler “greet, meet and eat” strategies that work in broker/dealers don’t align with a business model where fiduciary responsibilities, rather  When a boutique firm’s primary business is the institutional or high net-worth marketplace, some executives would rather manage portfolios than manage the product line of mutual funds. “We pay for investment research over mutual fund industry research,” said one CEO and portfolio manager of a boutique asset manager with just a handful of funds who

When a boutique firm’s primary business is the institutional or high net-worth marketplace, some executives would rather manage portfolios than manage the product line of mutual funds. “We pay for investment research over mutual fund industry research,” said one CEO and portfolio manager of a boutique asset manager with just a handful of funds who

Connect