Negative incidents can impact a company’s reputation, costing it millions. Most large companies have teams and procedures to respond to them. However, reputational damage can devastate smaller firms, especially those managing other people’s money. This guide explains how they can plan for crises. Read more »

Negative incidents can impact a company’s reputation, costing it millions. Most large companies have teams and procedures to respond to them. However, reputational damage can devastate smaller firms, especially those managing other people’s money. This guide explains how they can plan for crises. Read more »

See how marketing turned one mutual fund salesperson’s cold calls into real conversations—and tripled her meetings.

See how marketing turned one mutual fund salesperson’s cold calls into real conversations—and tripled her meetings.  Marketing coaches are often confused with fractional chief marketing officers (fractional CMOs), marketing consultants, and freelance marketing support. However, they are not the same things. This guide explains what marketing coaches do and how they can help financial companies achieve their promotional and sales goals.

Marketing coaches are often confused with fractional chief marketing officers (fractional CMOs), marketing consultants, and freelance marketing support. However, they are not the same things. This guide explains what marketing coaches do and how they can help financial companies achieve their promotional and sales goals.  Artificial Intelligence (AI) has changed how investors find and use information about asset managers and all things financial. This article explains how AI complements—and differs from—Google in search capabilities for investors and asset managers.

Artificial Intelligence (AI) has changed how investors find and use information about asset managers and all things financial. This article explains how AI complements—and differs from—Google in search capabilities for investors and asset managers.  Are you a wealth manager or other financial professional who wants to generate high-net-worth investor leads? The people you want to do business with are active on Linkedin, and you should be, too. This article explains how to leverage Linkedin to generate leads from prospective investors.

Are you a wealth manager or other financial professional who wants to generate high-net-worth investor leads? The people you want to do business with are active on Linkedin, and you should be, too. This article explains how to leverage Linkedin to generate leads from prospective investors.  Too many asset managers don’t create their websites for smartphones first. They prioritize desktop design and overlook mobile users. This is not good. Mobile-first design is important because more than half of all website traffic now comes from smartphones.

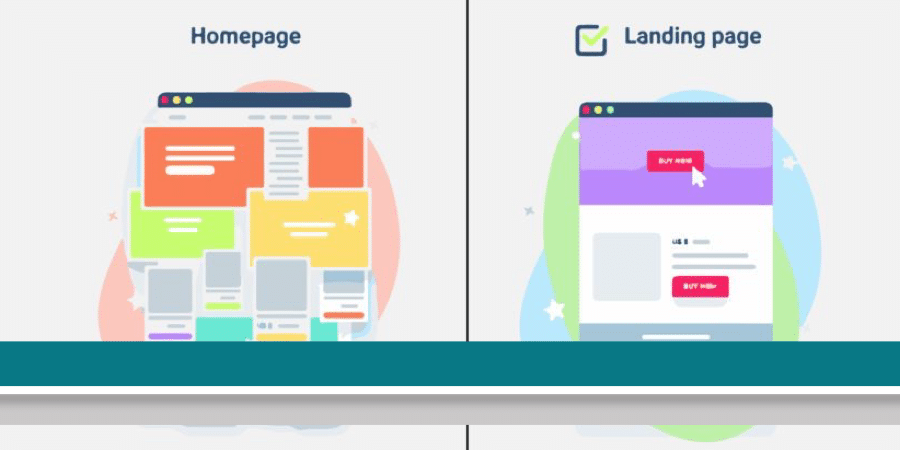

Too many asset managers don’t create their websites for smartphones first. They prioritize desktop design and overlook mobile users. This is not good. Mobile-first design is important because more than half of all website traffic now comes from smartphones.  What are landing pages, and why are they important for asset manager marketing? In this article, we’ll answer those questions to help you understand how financial services firms use them to get conversations and leads and provide tips on how to optimize landing pages.

What are landing pages, and why are they important for asset manager marketing? In this article, we’ll answer those questions to help you understand how financial services firms use them to get conversations and leads and provide tips on how to optimize landing pages.  This article explains what you must know to become a video marketing pro in the wealth management sector.

This article explains what you must know to become a video marketing pro in the wealth management sector.  Many wealth managers need help clarifying their messaging, service offerings, and who they serve. Long-term asset and revenue growth comes from having a clear focus on these things. This checklist will help identify your highest-value investors and services so you can base your business marketing on them.

Many wealth managers need help clarifying their messaging, service offerings, and who they serve. Long-term asset and revenue growth comes from having a clear focus on these things. This checklist will help identify your highest-value investors and services so you can base your business marketing on them.  When markets crash, your clients need to hear your voice—not silence. Here's how to communicate clearly when it matters most, turning market chaos into your competitive advantage.

When markets crash, your clients need to hear your voice—not silence. Here's how to communicate clearly when it matters most, turning market chaos into your competitive advantage.

Connect