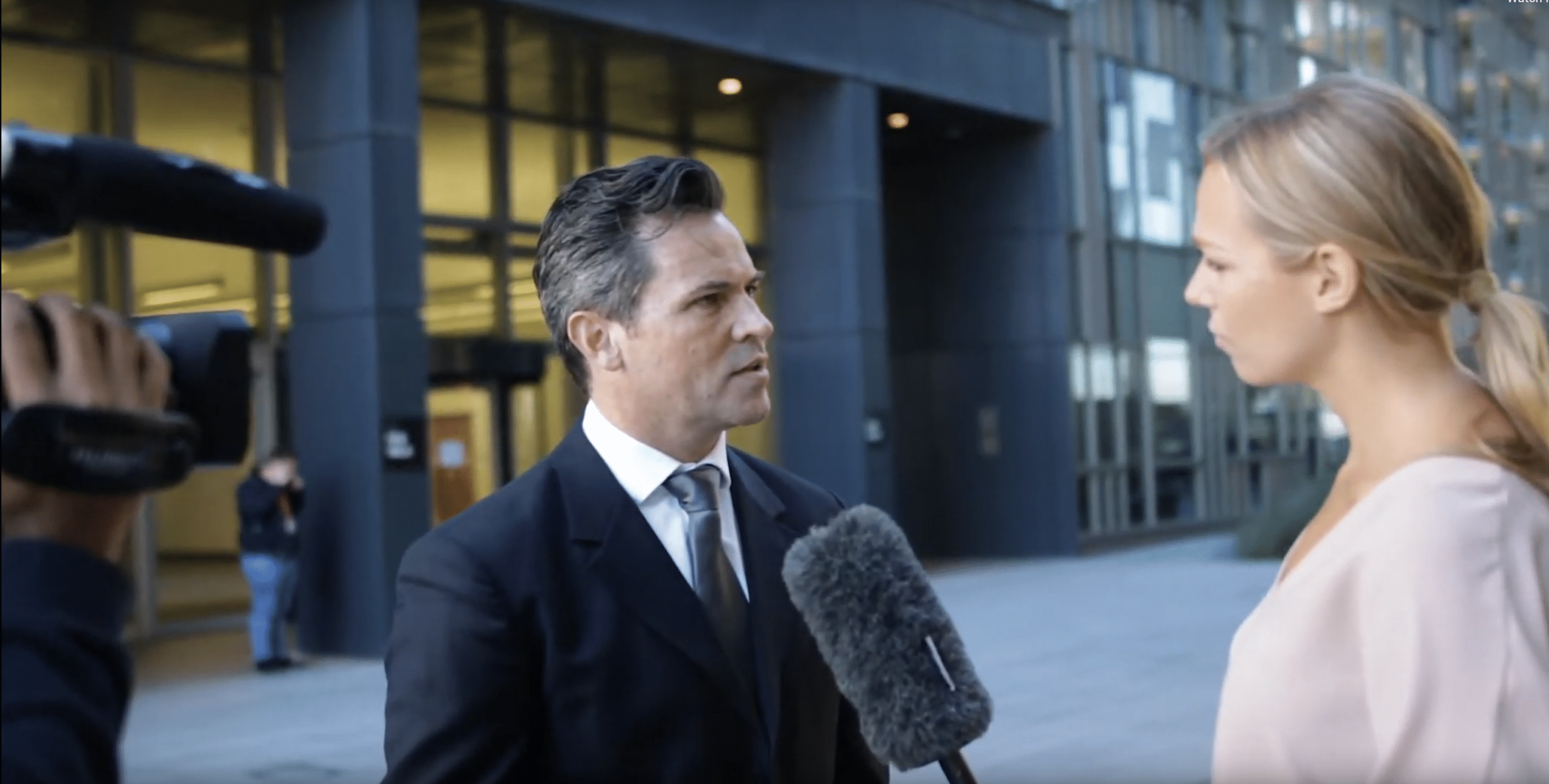

For asset and wealth managers, achieving thought leadership is essential. Thought leaders are viewed as people of influence, with recognized expertise, credibility and strong reputations. Thought leaders are financial professionals whose words matter. Of course, it’s difficult to become a thought leader. It requires a plan and a commitment to do the four things that most people won’t do. Read more »

For asset and wealth managers, achieving thought leadership is essential. Thought leaders are viewed as people of influence, with recognized expertise, credibility and strong reputations. Thought leaders are financial professionals whose words matter. Of course, it’s difficult to become a thought leader. It requires a plan and a commitment to do the four things that most people won’t do. Read more »

PR and SEO have very similar objectives, particularly authority. But an increasing number of asset managers are realizing that a good PR strategy coupled with a good SEO strategy can ensure your firm's content is actually found by the people who actually want it.

PR and SEO have very similar objectives, particularly authority. But an increasing number of asset managers are realizing that a good PR strategy coupled with a good SEO strategy can ensure your firm's content is actually found by the people who actually want it.  The twin slams of the spread of the Coronavirus and the first bear market in a decade have created the most challenging environment for asset managers since the Great Recession. How are asset managers handling the pandemic and client engagement?

The twin slams of the spread of the Coronavirus and the first bear market in a decade have created the most challenging environment for asset managers since the Great Recession. How are asset managers handling the pandemic and client engagement?  For asset managers looking to grow AUM, knowing what your target market wants and delivering it the way it wants is the key to increasing advisor engagement. Though the top-ranked leaders generally were the largest asset managers, the FUSE survey provides valuable insights for smaller firms seeking improved results from their marketing efforts.

For asset managers looking to grow AUM, knowing what your target market wants and delivering it the way it wants is the key to increasing advisor engagement. Though the top-ranked leaders generally were the largest asset managers, the FUSE survey provides valuable insights for smaller firms seeking improved results from their marketing efforts.  In a recent article, I suggested four ways boutique asset managers can transform their sales and marketing culture. But before you can implement these change strategies from the top-down, it’s important to create a strong business case, backed by research, that specifies how the changes you’re recommending will deliver the specific results you need to

In a recent article, I suggested four ways boutique asset managers can transform their sales and marketing culture. But before you can implement these change strategies from the top-down, it’s important to create a strong business case, backed by research, that specifies how the changes you’re recommending will deliver the specific results you need to  Remember when investors called your 800 number?

Remember when investors called your 800 number?  As uncomfortable as it may seem, now is the time to plan for such an event - while everyone is thinking rationally, and there is time to consider all contingencies.

As uncomfortable as it may seem, now is the time to plan for such an event - while everyone is thinking rationally, and there is time to consider all contingencies.  Citywire highlights it’s top Q&As in 2019, in which eight gatekeepers recount their best and worst investor interviews, from overconfident PMs to preposterous historical returns. This is my favorite column in Citywire.

Citywire highlights it’s top Q&As in 2019, in which eight gatekeepers recount their best and worst investor interviews, from overconfident PMs to preposterous historical returns. This is my favorite column in Citywire.  Watch our webinar replay to learn how stronger digital marketing can help you attract and retain customers.

Watch our webinar replay to learn how stronger digital marketing can help you attract and retain customers.  Portfolio managers and analysts generally feel most comfortable interacting with highly sophisticated institutional consultants and wealth managers who are well versed in the highly technical and jargon-laded lingua franca of the investment world. But as many asset managers find themselves struggling to capture new inflows, they’re asking portfolio managers and analysts to communicate directly with

Portfolio managers and analysts generally feel most comfortable interacting with highly sophisticated institutional consultants and wealth managers who are well versed in the highly technical and jargon-laded lingua franca of the investment world. But as many asset managers find themselves struggling to capture new inflows, they’re asking portfolio managers and analysts to communicate directly with

Connect